In the U.S., A Consumer Confidence Crisis Looms

Fluctuating tariffs damaged stock performance and negatively impacted consumer confidence.

How much?!

"I can't keep up with the President. Every day is something new. I just feel like we're living in uncertain times. [...] Everything is going up,” 42-year-old legal operations professional Anna Woods told the BBC on Saturday April 12th. At the time of interview, she had recently received a message from her son's summer camp warning that tariffs might affect pricing of standard gear such as T-shirts.

And indeed they will. The Budget Lab, a Yale think-tank, forecasts that prices for clothing will increase by 60% in the short-term; everyday pharmaceutical products could jump by 12%, and food prices rise by 2.6%.

The distinction in the price-increases is a consequence of the manner in which tariffs were applied. They are designed to intentionally harm manufacturing hubs in a bid to stimulate the return of manufacturing jobs to the U.S..

Worse still, fashion was already comparatively more expensive than other categories as inflation eases, stubbornly failing to fall with it, with prices rising 0.4% between February and March, according to data compiled by the U.S. Consumer Price Index.

If purchase patterns remain the same, UBS estimates a typical U.S. family will experience an estimated $4,700 jump in living expenditure due to the levies. As a result, price-sensitive consumers are reconsidering their expenditure. "I don't know if we can necessarily conclude it's panic-buying but there seems to be broad stock-up behaviour," said Michael Gunther, head of insights at ConsumerEdge.

Previous economic convention indicated that when tariffs are applied, the local currency strengthens because of the additional cost of buying imported goods, prompting consumers to invest more in locally made products. Scott Bessent, the U.S. Treasury Secretary, vociferously claimed that the dollar’s appreciation would be significant enough to offset a rise in inflation.

He was incorrect.

The emergence of questions around whether the U.S. economy is still a safe haven has prompted the dollar to lose value against the euro, the yen, the pound and numerous other currencies, making imports from those countries more expensive for Americans, even before tariffs are applied.

“Dense Fog” and Debt

Worryingly, even the mighty LVMH, a bellwether for industry performance, could not spend enough to maintain sales growth. In its Q1 earnings call, chief financial officer Cécile Cabanis reported a 3% year-over-year drop in Q1 sales, prompting an 8% drop in stock price and LVMH losing its position as the world’s most valuable luxury brand to Hermès.

On the call, Cabanis shared: “It’s true that aspirational clientele is always more vulnerable in less positive economic cycles and uncertainties, and it might have had some impact in the recent weeks, but rather on categories like wines and spirits and beauty.”

Many respected financial institutions including J.P. Morgan believe the result of the U.S. and China’s drop in trade will prompt a recession in the U.S. and significant challenges in China, which exports over $400 billion of goods to the U.S. each year. Or rather, did.

“Wealthy consumers’ stock market gains kept the economy growing in 2024 despite high prices, but the wealthy won’t feel confident enough to keep spending if this keeps up,” Bill Adams, chief economist at Comerica Bank, wrote in a recent analyst note.

CNN reported that Larry Fink, chief executive of BlackRock, the world’s largest asset manager, said last Friday, “today’s dense fog of uncertainty, triggered by Trump’s tariffs, is reminiscent of the 2008 global financial crisis.”

Some analysts are more positive, but not many. “The Dow Jones average is down about 15% from its high back in November. However, it’s still at the highest level it’s ever been from before late 2022,” wrote respected columnist Gene Marks in The Guardian. He points to the opportunity for the residential property market to be reanimated as mortgage and borrowing costs come down. “Will the slowdown cause a recession? Maybe. But lower interest rates mean a lower cost of borrowing,” he adds.

That may be true, but recessions spook consumers. Especially those in debt.

In 2024, U.S. credit card debt hit $1.3 trillion and automobile loans $1.8 trillion. What’s more, exposure to fluctuating stock portfolio performance is massive. Individuals and non-profits own an incredible $38 trillion in stocks as a result of technology simplifying investment processes and crypto-culture encouraging new cohorts of individuals to speculate.

Consumer Confidence Crisis

Consumer confidence is not immune from the budgeting uncertainty the Trump administration’s negotiation tactics and messaging-style create.

“Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year,” Joanne Hsu, the respected University of Michigan’s consumer sentiment survey’s director, said in a release. “This decline in [March], like [February’s] is pervasive and unanimous across age, income, education, geographic region and political affiliation,” she continued.

Consumer confidence is now 0.8% above the lowest ever recorded.

It should be noted that the University of Michigan data is survey data, and thus less reliable than ‘hard’, retroactive economic expenditure data. Indeed, Fed Chair Jerome Powell said at an event near Washington, DC. “Sometimes the surveys are very negative, but they keep spending. People spent right through the pandemic and they spent right through this time of higher inflation.”

Alternatively however, New York Fed’s President John C. Williams said at an event in Puerto Rico that he expects economic growth to slow sharply this year, pushing up unemployment, and for inflation to accelerate.

A report released by the Bureau of Labor Statistics in 2025 states that consumers are at risk of bearing the brunt of the costs from tariffs. Similarly, Amazon chief executive Andy Jassy said in an interview on CNBC that third party sellers are likely to pass on costs to their customers. “Depending on which country you’re in, you don’t have 50 percent extra margin that you can play with,” he said. “I think they’ll try and pass the cost on,” he explained.

A Headache for 309,400,000 People

The recent salvo of technology tariffs could be particularly wide-ranging in their impact on consumer confidence. Pew Research found that 91% of Americans own a smartphone. That means the cost of new hardware is now a headache for 309,400,000 people. And for good reason.

By way of example, of those U.S. smartphone owners, 57% own an iPhone, according to Oberlo. In 2025, 90% of Apple’s iPhone production and assembly is still based in China and produced by Foxconn and Pegatron. The remainder is produced in Vietnam and, more nascently, in India.

UBS analysts estimate that a $1,199 iPhone 16 Pro Max assembled in mainland China could increase by 67% or $800, while an iPhone 16 Pro assembled in India could see just a $45 increase. Apple is reportedly seeking to ramp up production in the subcontinent as a result.

UBS’ estimates were correct at least for a day or two before the tariffs changed again. They were applied to Trump’s 125% tariff on Chinese imports and 90-day pause on all other “reciprocal” tariffs. Before the rose garden address, UBS put those price increases at $675 and $120. Qualitative reporting indicates the sporadic but significant and planned investment into smartphones by consumers is already becoming a more conscious and strategic purchase.

Wendong Zhang, an assistant professor of applied economics and policy at Cornell University, told The New York Times that 73% of smartphones, 78% of laptops, 87% of video game consoles and 77% of toys in the United States come from China.

Automobiles are another widely shared concern. The 25% tariffs on imported cars is expected by analysts to raise car prices, lower sales and disrupt the auto industry due to the scarcity and cost of imported parts. Carmax, a U.S. car dealership shared in The New York Times, shares: “We are removing the timeframes associated with [business goals] given the potential impact of broader macro factors.”

This kind of potential price vacillation forces all but the most price-insensitive consumers to reconsider their spending habits. Tariffs are a regressive rather than a proportional tax, which means they have a disproportionate impact on lower-income individuals and families.

Economists worry that consumers will end up rejecting these price rises and instead significantly curtail their spending. Such a curtailment in spending would become the stimulus of the economy tipping into a recession if businesses cut personnel costs as demand falls.

Admittedly, the luxury industry is increasingly relying on the same 2% of its consumers to drive its growth. However, even if some businesses’ top 2% of consumers are responsible for between 40-50% of sales, no scaled business can remain profitable without effectively converting aspirational consumers.

Whether Trump’s tariff strategy is his administration playing 4D chess (not chequers!) with the global economy, skilled brinkmanship in the art of the deal, or a six-timed bankrupt near-octogenarian surrounded by unqualified sycophants, is irrelevant to the damage it has caused to the industry’s growth prospects in the near-term.

Chinese Manufacturing Tok: Luxury’s Value Proposition Slips Further

In times of low consumer confidence, while the spectre of a recession looms and geopolitical risk and disruption increases, businesses that have traditionally invested significantly in brand — building an emotive connection with consumers — typically have an edge. Consumers will swallow price increases due to their preference for a brand and loyalty to it.

However, the luxury industry’s pricing strategies over the past five years may have squandered that advantage. HSBC analysis revealed that luxury price increases have added 52% to the cost of the average luxury product in Europe between 2019 and 2024.

Perversely, luxury does have the margins to price its goods more rationally. However, its aggressive pricing strategies, aligned to revenge buying and wealth polarisation, did more than create short-term double-digit growth for the industry and increase barriers to entry for lower-to-middle-income consumers.

Inadvertently, such rampant price increases called into question the value proposition underpinning our contemporary iteration of the luxury industry: in all its globalised, scaled and at-times-mass-produced reality.

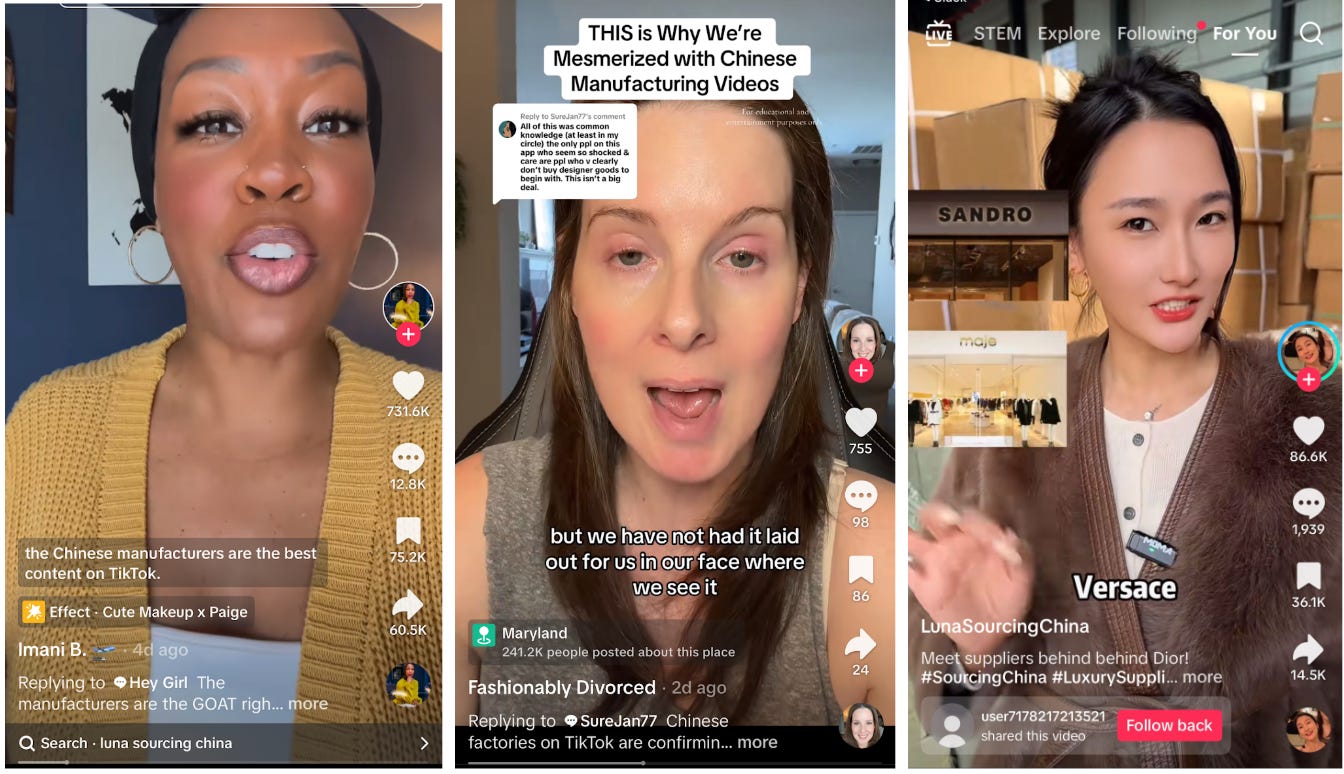

Luxury now faces another scandal impacting its perceived value in the minds of consumers. Having previously publicised poor manufacturing standards and materialisation, the reality of the industry’s sourcing practices are now entering an already critical zeitgeist on TikTok and other short form video apps. The viral @LunaSourcingChina and others are now claiming to identify the suppliers of Dior and other major brands, prompting an avalanche of memes and likes.

Though slivers of it appear authentic and may well be, almost all of the content on Chinese Manufacturing Tok regarding luxury sourcing strategies is misinformation. Much of the video content that has gone viral are shots of counterfeits. Yet, in the post-truth era ushered in by the U.S. administration’s political strategies, that is irrelevant to the harm to public perception.

“Now people are seriously doubting the truth around expensive fashion,” says one creator, another: “it's over for luxury brands now.” In this context, will luxury brands be confident enough to push significant cost increases over to consumers? Will quality standards survive the scrutiny of such high pricing?

Dupe culture has already soared. The Guardian reports that 33% of U.S. adults intentionally bought a dupe of a luxury product. 50% say they buy dupes for the savings. 17% of U.S. consumers say that even if they could afford the genuine article, dupes are a great alternative. Indeed, the total value of counterfeit and pirated goods is $3 trillion this year, triple the amount in 2013, reports the Organisation for Economic Co-operation and Development.

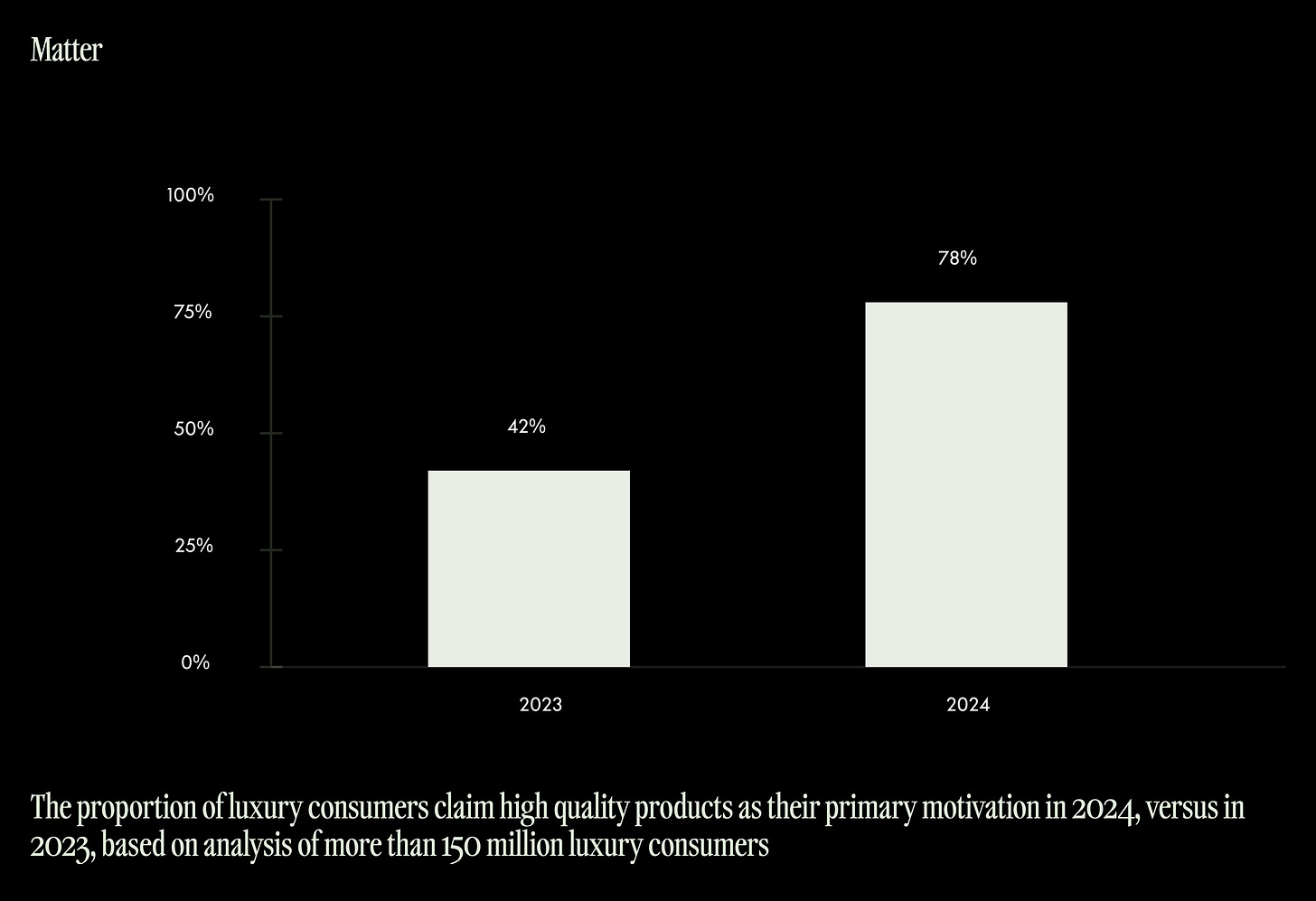

Quality, not branding, is of greater and greater importance in consumers’ purchase motivations. In 2023, Matter analysed proprietary data on over 150 million majority Gen Z and Millennial luxury consumers. Only 42% of the audience claimed high quality products to be their primary motivation in purchasing luxury.

In 2024, Matter analysed another comparable data set, again of over 150 million luxury consumers, the majority of them Gen Z and Millennial. Over 78% claimed high quality products as their primary motivation. That sentiment is pertinent, as the reality of sourcing strategies enter the zeitgeist even more than they had previously.

What’s more, many other segments in the market plan to increase visibility and transparency around pricing allowing them to position price increases as rational to customer cohorts.

Redefining Reciprocal

A large part of the budgetary challenges facing both businesses and consumers is the uncertainty created by the solipsistic manner in which tariffs have been applied.

To illustrate, back on Saturday the 12th of April, a U.S. customs notice shared that some technology products would be excluded from a 125% tariff levied on Chinese exports. Apple’s and chip-maker Nvidia’s stocks were set to soar. However, as soon as the news broke, President Donald J. Trump took to Truth Social.

“There was no Tariff ‘exception’... These products are subject to the existing 20% Fentanyl Tariffs, and they are just moving to a different Tariff ‘bucket… We are taking a look at Semiconductors and the WHOLE ELECTRONICS SUPPLY CHAIN in the upcoming National Security Tariff Investigations.”

The next day, on Sunday, U.S. commerce secretary Howard Lutnick said in an interview on ABC, “He’s saying they’re exempt from the reciprocal tariffs, but they’re included in the semiconductor tariffs, which are coming in probably a month or two.” Though the European markets still managed to rally on Monday, in the afternoon, at the door of Air Force One, President Trump took further questions from reporters seeking clarification.

“Like we did with steel, automobiles and aluminum — which are now fully owned, we will be doing that with semi-conductors, with chips and numerous other things and that will take place in the very near future […] and another one, is drugs and pharmaceuticals,” explained the president. Yet another “salvo,” in the escalating trade war, launched on April 3rd.

Critics of the Trump administration were quick to point out that the tariffs displayed on the President’s now infamous presentation prop in the rose garden that day last week were consistent with those that a ChatGPT query provides.

What is irrefutably clear is that trade deficits were the focus of the calculations and not a more complex equation that took into account the relative prosperity and consumer spending power in the world’s “family of nations”. In fact, considerations beyond trade deficits are significant because of two things, one stateside and one international.

Stateside, in the U.S., citizens invest and spend more than they earn. That gap in earnings and expenditure means the U.S. buys more from the world than it sells. “So as long as that continues, the U.S. may continue to keep running a deficit despite increasing tariffs with its global trading partners,” writes Ben Chu and Tom Edgington of BBC’s Verify.

Internationally, the chasm between the high-wage economy of the U.S. and the consumption capability of manufacturing hubs — the majority of which have poor labour-abuse records and intentionally maintain low wages to sustain cheap exports. Put simply, lower-to-middle-income economies cannot afford many American produced goods, whereas American consumers have become expectant of the cheap prices imports from lower-income countries create. This engenders significant trade deficits in specific conditions.

It is why goods from Vietnam (46%), Cambodia (49%), Bangladesh (37%), have been tariffed so highly. Fashion manufacturing hub Vietnam is the U.S.’s third largest importer — such is the scale of its fashion imports. Dr. Sheng Lu, Professor in the Department of Fashion & Apparel Studies at the University of Delaware found that 98% of U.S. clothing and footwear sales were of imported.

Perhaps it is necessary to add here that a significant proportion of luxury manufacturing is centred in the South East Asian hubs mentioned above. What’s more, in the same rose garden announcement, the EU, the home to two of luxury’s greatest conglomerates and elite manufacturing capabilities, became subject to a 20% tariff. China was made subject to a 34% tariff on top of the previously announced duties, it later leapt to 145% following a later presidential announcement. Add India, tariffed at 27%, and you have levied the most significant manufacturing regions of the luxury industry.