Social Media Is Too Expensive

User behaviour means digital communication at scale is over. Matter identifies the alternatives.

Two years ago, investment in social overtook investment in paid search as an advertising channel, growing 25% YoY and exceeding $137 billion – by contrast, in 2016, that figure was just $16.3 billion. The fashion industry is habitualised to performance marketing and social brand building as key business drivers.

But while far from insignificant in purchase journeys, those strategies now require significant if not prohibitive budgets. What’s more, the true direction of travel with regards to consumer behaviour and engagement is being transformed:

Discovery

ChatGPT is a shopping assistant now. AI Overviews on Google prioritise organic links over ads. TikTok is Gen Z’s primary search engine. Data from Wakefield Research puts Gen Z’s attention span for advertising at 1.3 seconds. Brand control no longer exists.

Reach & Engagement

Algorithmic recommendations are “built brick-by-brick” by users’ behaviour, with following now an afterthought for the young. Their algorithms will ensure they see the content that keeps them in-app. The majority of consumers no longer trust brand statements or influencer recommendations. In January 2024, Instagram's median engagement rate was 2.94%, but by January 2025, it had dropped to 0.61%.

Experience

Platforms are becoming increasingly ‘enshittified’. AI sludge is quickly drowning out organic content and beginning to eat itself. X and allegedly Meta are intentionally or negligently driving engagement through hate by prioritising polarising comments.

As a result, executives should once again appraise the ROI of their social investments. Given its decreasing relevance to discovery, the atomised reach algorithms create, and poor user experience, how long can mainstream social channels continue to justify outsized investment?

Even accepting diminishing ROI, the risk to brand is too rarely discussed. 68% of respondents to a BoF survey in 2024 stated they were unsatisfied with the amount of paid media and sponsored content on their feeds.

There are other, better routes to discovery, reach, engagement, and experience. After analysing the shifts to consumer behaviour driving the changes, Matter outlines the alternatives below.

“Chat, What Do I Wear Today?” – How Discoverability Is Changing

TikTok’s power is in its status as a discoverability app, with an AI-integrated search function which is considered vastly more reliable and thorough than Instagram’s equivalent. Indeed, Gen Z’s adoption of TikTok over Google led the latter to introduce a “Short video” tab on search in the hopes of recouping the estimated 62% of the 18-24 demographic who use TikTok as their primary search engine.

Complicating matters further, an estimated 90% of Gen Z are using tools like ChatGPT weekly, and Open AI’s recent rollout of shopping recommendations will only tighten young consumers’ embrace of AI for product discovery. Creators are already sharing prompts to turn ChatGPT into a colour analysis tool or even to act as an on-demand personal shopper and stylist.

The recent integration of AI summaries into the TikTok search feature is a prescient move: BoF reported last year that 82% of customers want AI to assist them in researching what to buy.

Data Scrape Discoverability Strategies

The next generation of consumers using these tools to shop, will not find your brand unless specific data strategies are implemented to support AI assistant search. AI assistants answer shopping queries using a mix of pre-trained knowledge and real-time data from sources like retailer APIs, web searches, or scraped content where permitted. Results are ranked based on relevance, availability, reviews, and sometimes commercial partnerships.

This includes media coverage. The New York Times is suing Open AI for training models on its content and has indicated it is unwilling to make its data available to agents. Publications like The Guardian, The Washington Post, and Condé Nast have meanwhile signed data deals with OpenAI, making their reporting and archive available.

According to ChatGPT – the agent we asked, not OpenAI itself – partnering with fashion aggregator sites, ensuring product links are crawlable and public, and being mentioned in Q&A style content like Reddit, Quora, and influencer shopping guides, further a brand’s chances of appearing in advice results. Paid advertising is not on that list. Brands looking to maximise their presence on this nascent but rapidly influential channel should prioritise making their data as available as possible in the places that the LLMs rely upon. No doubt an evolving art, and the SEO strategy of the future.

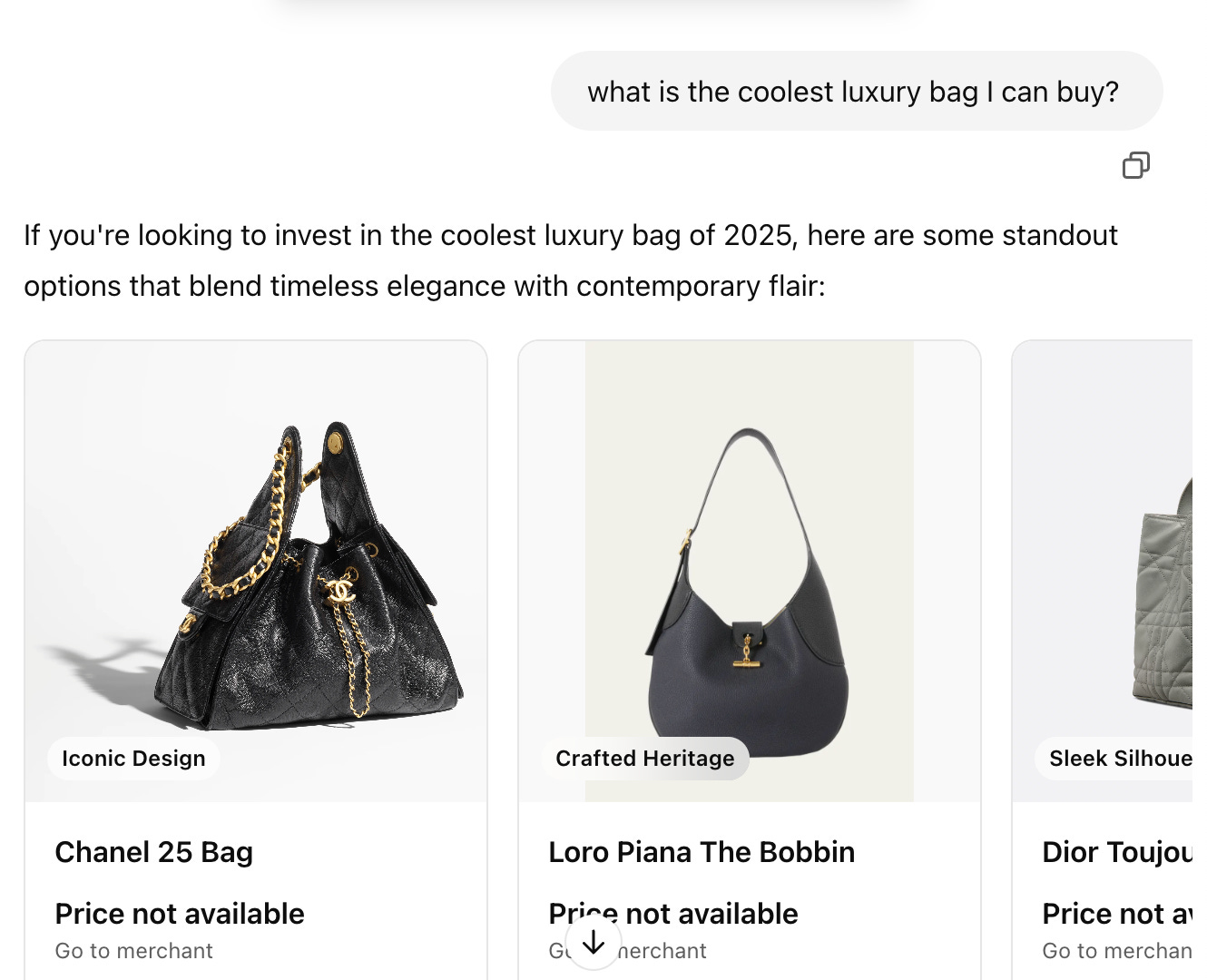

To illustrate: Matter asked ChatGPT, “What is the coolest luxury bag I can buy?”.

None of the listed sources provided direct links to brand websites or channels.

Of ten results, four were LVMH-owned and all were major luxury brands.

Data was sourced from Tatler Asia, Who What Wear, Marie Claire, and some small-scale fashion blogs with low followings and SEO copy.

The language ChatGPT generated around the product imagery – calling out Chanel’s “Iconic Design” and Dior’s “Sleek Silhouette”, for example – is entirely independent from brand-provided language.

When pressed, the ChatGPT agent explained that the copy mostly derived from “some product metadata and tags from fashion retailers or curated articles”.

This is significant:

As of May 2025, ChatGPT has nearly 800 million weekly active users and around 122.58 million daily users.

The majority of ChatGPT users are between 18 and 34 years old, making up 54.85% of the total user base and largely Millennials.

Millennials were the leading customer groups of personal luxury goods, accounting for 46 percent of all luxury goods spending worldwide.

Brand Popularity Dictates LLM Probability

For smaller brands, the predictive nature of generative AI – where data is used to infer the most likely answer – could be an unexpected hurdle. LLMs work on the basis of probability, meaning they generate responses by assessing which words, phrases, or concepts are most likely to follow from the input they receive. This predictive approach is effective for widely recognized brands or well-documented topics, where vast amounts of data provide a reliable basis for accurate responses.

But, as Vogue Business recently reported, in response to a shopping query “one of the referenced sources was [...] the Swedish brand Asket, [...] but the resulting recommendation was for H&M Group-owned Arket.” This predictive limitation is a disadvantage for smaller brands trying to carve out a niche in a competitive market.

Reaching Who, Exactly? – The End of Speaking At Scale

As the inequality gap widens, the concerns of the top 2% of customers driving 50% of a brands’ revenue do not overlap with those of the bottom 50% who drive just 15%. Effective performance marketing is impossible under these conditions: most public brand content is irrelevant to the HNWIs, emerging as a risk rather than a benefit.

Big platforms are losing influence as trust and authenticity fade, reports Vox Media, “with more people flocking to AI chatbots, niche communities, and platforms like TikTok. This signals a massive shift and opens the door for disruptive entrants that will offer more authentic, trusted experiences.”

A 19-year-old member of the Matter Intelligence community told us: “I just find posting on Instagram so scary now. Everyone's so scared about not coming across as their best version of themselves. People want to reinvent themselves every day.”

Furthermore, paid media is now both more expensive and less effective. Gen Z grew up surrounded by more advertising than any previous generation (studies estimate that we see anywhere between 5,000 and 10,000 adverts a day). An estimated 32.8% of people worldwide use ad blockers. According to the Vogue Business Index, Instagram engagement has dropped 19%, and views on Youtube have dropped by 90% since last year’s luxury slowdown. Today, young consumers are hyper-conscious of marketing tactics and wary of being sold to.

Big Platforms, Bad Experiences

Even further diminishing the ability of brands to communicate en masse: social polarisation. Thanks to personalised algorithms “young men and women now increasingly inhabit separate spaces and experience separate cultures,” writes John Burn-Murdoch for the Financial Times. A divide most recently illustrated by Homme+’s most recent cover – Donald Trump, as shot by Terry Richardson – simultaneously lauded and criticised to the point that the magazine shut off its Instagram comment section.

This is also having a dramatic effect on user experience. As tech brands attempt to appease the U.S. administration, the user experience of many channels is deteriorating. Consider Elon Musk’s enshittified and bot-addled X, and Meta’s removal of fact-checking and changing definition of “hate speech.”

It is no surprise that 66% of consumers find the quality of information is deteriorating online, making it difficult to find reliable sources, states Vox Media data. The situation is far from improving: Republicans in the U.S. are pushing against AI regulation and Musk’s Grok is reportedly generating white supremacist propaganda.

The evolution we’re seeing on social media is gaining pace: Instagram’s regulated but relatively uncontroversial curated aesthetics was succeeded by the entertaining chaos of TikTok. Now, finally, channels have evolved into “rage bait” – socially-manipulative content which aims to drive engagement at any cost.

Today, 25% of daily social media users say they encounter hate speech regularly -- the number goes up to 34% for Twitter/X users -- Morning Consult reports. A study conducted by researchers at the University of Pennsylvania and the University of Southern California found that 20% respondents reported liking an advertiser less after seeing their ad next to user-generated hate speech. There was a 35% reduction in the likelihood of users clicking on such ads. The result is an increasingly split user base on social media.

Bot Engagement & Fallow Following

Most studies estimate that at least 20% of engagement on social media comes from bots. TikTok alone has an estimated 256 million fake accounts. This will only multiply as AI sludge takes hold.

Behaviour and views are now significantly more important than following. Unlike its predecessor, Instagram, the TikTok For You Page is curated based on the engagement of the content, not the following of the user. Due to its algorithm’s orientation around an interest-graph rather than a socio-graph, promoting content to users based on their interests not their social network, TikTok effectively democratised reach. Xiaohongshu and Douyin had already done this in Asia, and YouTube Shorts and Instagram Reels followed suit.

Hence the often repeated mantra in the platform’s comment sections, “I built this FYP brick-by-brick”. Influencer fatigue sees two thirds of consumers expressing low trust in celebrity influencers, as per Vogue Business. Matter’s 19-year-old source told us: “You'll see the same video on so many different accounts. So I don't really feel the need to follow them.”

Brand Association

The deluge of AI sludge is already here, with 90% of online content estimated to be synthetically generated by 2026.

Search “luxury brand guardians” on TikTok for a sense of AI’s potential impact on luxury’s scrupulous image reputation. The “Hermès” video has 5.9m views alone (an average @hermes Reel receives around 300k views). We have already lost brand control: this content will endlessly reproduce itself, with or without brand buy-in. In fact, arguably being on social media at all awards credibility to the AI drivel. So where should brands direct that budget instead?

The end could very well be nigh. Mark Zuckerberg recently dictated that Meta AI would significantly disrupt the advertising industry as “the ultimate business results machine”.

On the other side of the spectrum, small channels and private communities are gaining ground. Private and smaller communities are being formed on Substack, Patreon, Discord. And special interest apps like Letterboxd and Strava remain untapped resources for luxury-relevant customers.

The New Era of Social Strategies

Targeting by interest

Brands are taking their first tentative steps into new small and private platforms. The Real Real, Hinge, and Tory Burch have all launched a Substack newsletter. Louis Vuitton and Gucci briefly experimented with Discord servers. The latter short-lived experiments outline the risk in immediately establishing a brand presence on these platforms, which are often celebrated by users as offering a more organic alternative to brand-ridden mainstream social.

Perhaps more fruitful – for both reach and building brand goodwill – are the partnership opportunities available on these platforms. The top fashion Substacks are run by individuals: compare top publications Big Salad (183k subscribers) and The Cereal Aisle (100k+) with The RealReal (3k) and Tory Burch (4k).

Largely untapped, special interest apps are ones which tend to appeal to higher income and price insensitive consumers – but not yet being effectively utilised by brands outside of the wellness space. Strava, an app for runners (as per the Financial Times, “exercise tends to be a rich person’s pursuit, but running skews even richer”) numbers 135 million active users of which 76% are Gen Z and Millennials.

Previous brand collaborations include Hoka and Lululemon, taking the form of global challenges and “ghost races” as well as partnerships with local run clubs. Letterboxd, whose “top four films” interviews are now a recognised staple on the red carpet, is an app for cinephiles (as per Kantar: “those who claim to have visited the cinema five or more times ‘in the last six months’ are over twice as likely as the average adult to have a family income of £75,000+”). A space almost entirely underutilised by brands: opportunities could include branded outdoor screenings and local film club events.

Pop-ups – Genuine sub-culture connection

“In a digital world, physicality is everything. [...] The branded product is a souvenir to an experience. An experience that puts you in the know,” Izzy Farmiloe writes in Dazed Studio’s newsletter ‘The Weekly Echo Chamber’.

A café or a themed drink is not enough anymore in a space where consumers have access to Emma Chamberlain’s Warby Parker “kiosk-o-thèque” on Sunset Boulevard, Blank Street’s tattoo parlour in Kings’ Cross, Prada’s branded wet market in Shanghai, Miu Miu’s Summer Reads in Paris, New York, and London, or Olaplex’s “hairducation” event on Broadway. These events are not sales-driven, focusing on delivering a “third space” which speaks to consumers’ increasing desire for curated but publicly accessible moments.

The appeal of an affordable if ephemeral piece of a luxury brand, attained through engagement with an activation, is still at times compelling to low-value consumers. The right concept and right market create significant brand reach through the resulting UGC. The activation and merch become a prop to cast the aspirational customer in one of the selection of aesthetic lifestyles they project.

CRM, text, email, dark social – Direct communication

While traditional social and paid strategies may be waning in influence, consumers are still buying primarily online, with some studies suggesting that mobile phones are the most popular devices people use to shop. In the beauty industry, SMS strategies are both more common and currently more effective: beauty shoppers are twice as likely to convert after receiving an SMS “cart abandonment message” and 2.6 times more likely to convert after receiving a price drop alert through SMS, as per WWD. However, the report also showed “consumers embracing SMS in the fashion vertical [...] and becoming more comfortable purchasing directly from their phones”. McKinsey’s Quarterly report at the beginning of 2025 emphasised the use of generative AI in personalising SMS, CRM, and email communications.

Dark or private social points to another potential area for engagement, particularly in effectively targeting the global South. As BoF Insights director Rawan Maki noted at Crossroads last month, for younger consumers in this part of the world, “spaces are newly emerging where the customer has more control on shaping the narrative.” She gives the example of the technical menswear community on Reddit: “For example, if you are a fan of brands like Arc’teryx, the North Face, Reddit has a huge and burgeoning forum where all of these fans go and dispute and talk about the qualities of the brand.”

“The reason that's so powerful is because this dialogue is led by the customers themselves as opposed to the brand dictating the dialogue,” says Maki. Some media organisations have already employed organic Reddit strategies, including partnering with subreddits to host an “Ask Me Anything” with a relevant expert.

Spaces like r/femalefashionadvice (5.8 million members) and r/malefashionadvice (6.3 million members) are sources of information and education for a consumer base increasingly concerned with trust and knowledge. An opportunity for brands to justify their value proposition.

Gaming and Snapchat – Where young people are speaking to each other

Reportedly, the only way to contact Barron Trump as a fellow student matriculating at his college, if you were so inclined, is through his gaming handle, which he allegedly hands out to friends on NYU’s campus.

For younger generations, the emphasis is on private and personal communication. Posting publicly has become less common, with even Instagram head Adam Mosseri admitting: “People are sharing to feeds less, but to stories more and in messages even more still.”

63% of Gen Z prefer Snapchat because "it's more personal than other social media”, as per Ypulse. A 19-year-old member of the Matter Intelligence community told us: “With Snapchat, you literally go on there to message your friends. It’s the first app that everyone gets. I do everything through Snapchat. Even if I'm ringing someone, I'll just call them on Snapchat.”

This is a generation which has grown up on Snapchat, where messaging, mapping, and gamified streaks seed engagement, locking a large majority of their digital engagement in the app. Advertising is limited to the tabs on the app that don’t serve these use cases. The commercial potential of Snapchat, however, comes from integrating advertising into the existing use cases which its community has built a digital space around.